Project Title:

Creating Custom Insurance Calculators with Compeer Financial

Industry:

Agriculture Insurance

Technologies and Tools:

Microsoft Azure, Custom Web Applications, Salesforce Integration

Client:

Compeer Financial, a leading provider of financial services to farmers and rural communities, recognized that they were lagging in educating farmers about their crop insurance products and dairy revenue protection (DRP) options. The team relied on basic tools and maintained extensive spreadsheets filled with complex data, making it challenging to keep up in an industry where pricing information is constantly evolving.

Challenge:

To become a market leader, Compeer Financial needed advanced tools that could effectively communicate the value of their offerings. They approached Emergent Software to develop two calculators: one for comparing crop insurance products and another for calculating the federally mandated price for dairy revenue protection endorsements. The lack of efficient tools was hindering their ability to provide timely and accurate information to farmers.

Solution:

Emergent Software collaborated with Compeer Financial to create a custom-built web application for generating personalized insurance quotes for farmers. This application incorporated essential parameters like field location, projected crop prices, yields, and the farmer's risk tolerance. The team compiled various market, pricing, insurance, and geographic data sources to ensure accurate calculations. The tool also features the ability to generate PDF quotes and integrates with Salesforce for streamlined data management.

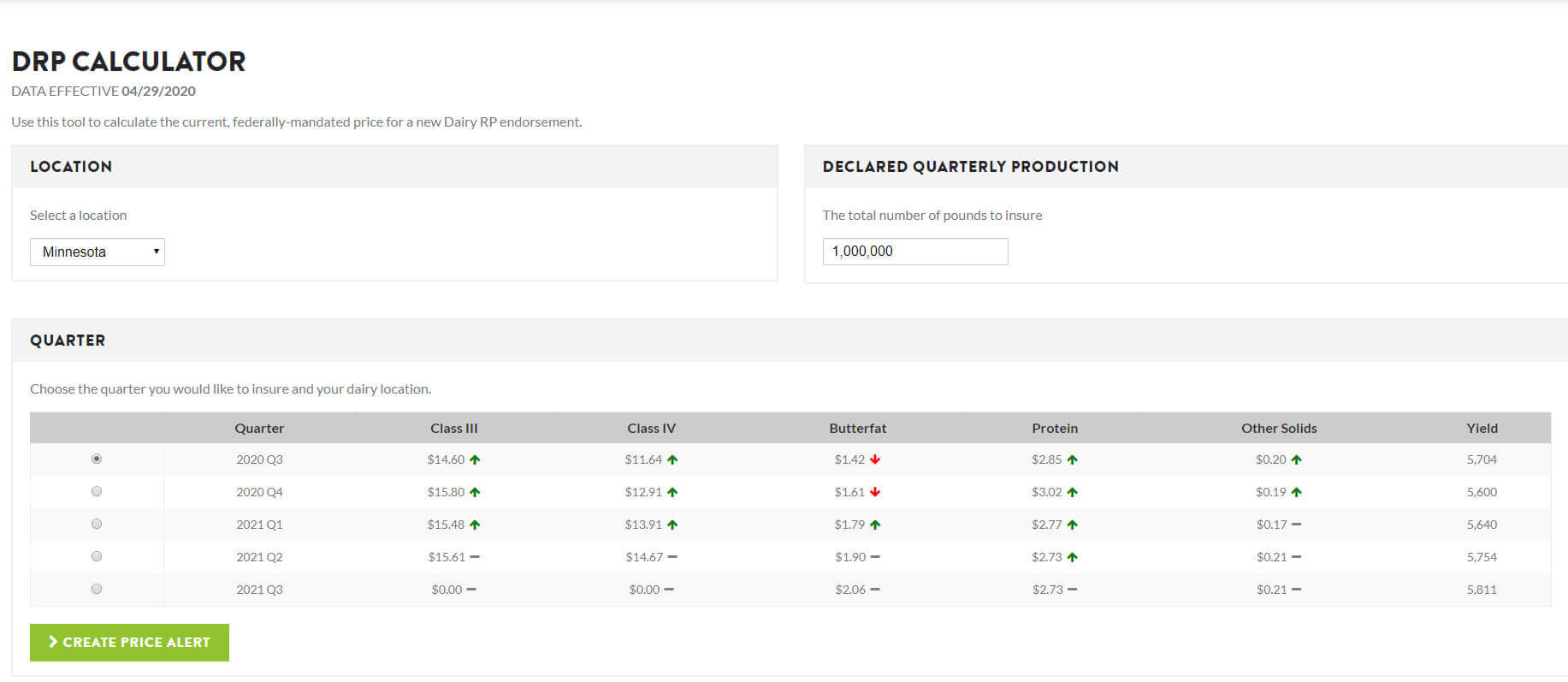

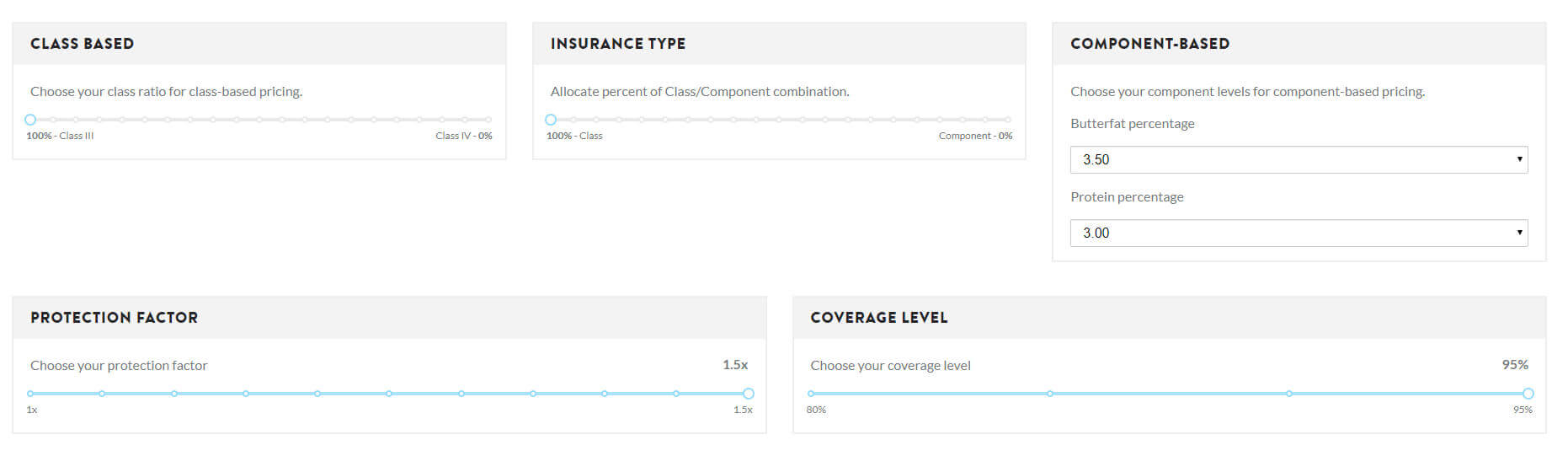

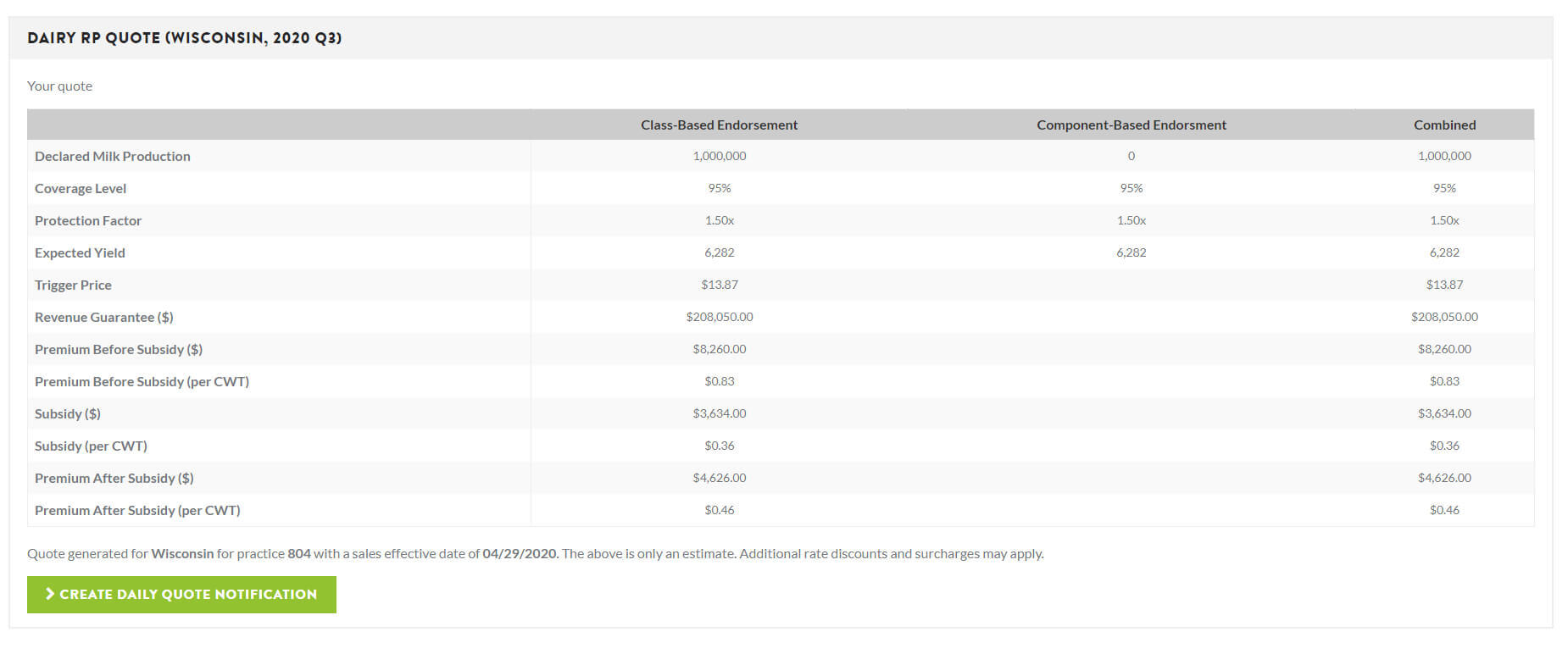

Additionally, Emergent Software developed a Dairy Revenue Protection Calculator tailored to Compeer Financial's branding and specific needs. The calculator pulls public dairy market data into a data warehouse, utilizing a Monte Carlo statistical model for projections. The final product enables users to set up personalized email notifications for price alerts and daily quote updates, significantly improving their ability to track market changes.

Key Features:

- Custom Crop Insurance Decision Tool: A web application that automatically generates personalized insurance quotes based on key parameters, helping farmers make informed decisions.

- Dairy Revenue Protection Calculator: A branded tool that integrates market data to calculate dairy revenue protection options, ensuring farmers receive tailored information.

- Email Notifications: Users can set up personalized alerts for price changes and daily updates, enhancing their ability to respond to market fluctuations efficiently.

Results:

Thanks to the collaboration with Emergent Software, Compeer Financial's agents are now equipped with custom applications that provide instant calculations for crop insurance and dairy revenue protection options. This transformation allows agents to assist farmers in making well-informed insurance investment decisions directly in the field.

Emergent Software continues to support Compeer Financial, enhancing their calculators, streamlining processes, and solidifying their position as leaders in the agricultural insurance market.

Testimonial:

“They're great to work with–very creative, solutions-oriented, and proactive about driving projects forward.”

Cullen Kennedy,

Project Manager – Compeer Financial

Technologies Used